Why Property Is Still a Safe Long-Term Investment in Australia

- Deepak Mehta

- Jan 25

- 3 min read

Every few months, a new headline predicts the "inevitable" crash of the Australian property market. If you have been watching the news lately, you might feel hesitant about jumping in. Between interest rate discussions and global economic uncertainty, it is natural to wonder if the golden age of Australian real estate is over.

But when you strip away the noise and look at the fundamentals, the story changes. Property in Australia has never just been about speculative gains; it is built on essential human need, limited land, and a banking system that underpins the entire asset class.

Here is why Australian property remains one of the safest vehicles for long-term wealth creation, even in today's shifting market.

The Supply and Demand Math Doesn't Lie

The most significant safety net for property investors right now is a simple lack of supply. Australia is currently facing a chronic housing shortage that isn't going away anytime soon.

Construction costs have risen, and labour shortages are slowing down new builds across VIC, NSW, and QLD. At the same time, Australia’s population is growing faster than we can build homes to house everyone. When demand consistently outstrips supply, prices and rents are naturally pushed upward.

For investors, this imbalance provides a layer of security. Even if market sentiment dips temporarily, the physical need for housing keeps the floor high under asset values.

History Favours the Patient Investor

There is a popular myth that property prices double every 7 to 10 years. While that timeline varies depending on the suburb and economic cycle, the long-term upward trend is undeniable.

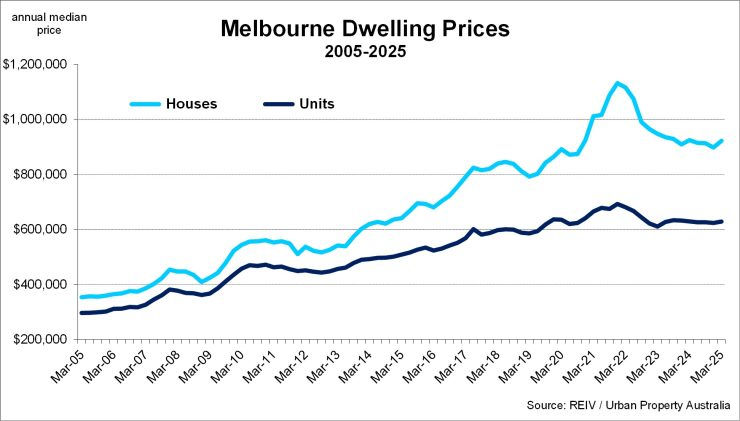

Over the last 20 years, Australian dwelling values have weathered the Global Financial Crisis, a global pandemic, and multiple interest rate cycles. In almost every instance, the market didn't just recover; it exceeded previous highs.

This resilience is why time in the market beats timing the market. If you bought a median-priced house in Melbourne or Sydney twenty years ago, short-term fluctuations from that era are now irrelevant compared to the capital growth you have achieved since.

You Can’t Live in a Crypto Wallet

One of the biggest advantages property has over shares or cryptocurrency is tangibility. It is a "brick and mortar" asset that provides a genuine utility. No matter what happens in the stock market, people always need a roof over their heads.

This tangibility also makes property an excellent hedge against inflation. As the cost of living rises, so does the cost of building new homes (materials and labour). This increases the replacement cost of existing properties, dragging their value up along with inflation.

The Banks Are on Your Side

Banks in Australia are conservative. They don't lend hundreds of thousands of dollars for assets they think will disappear overnight.

The fact that lenders are willing to let you borrow up to 90% (with LMI) or 80% of a property’s value is a testament to the stability of the asset class. They know that historically, the default risk is low and the asset value is stable.

This ability to use leverage, using the bank's money to control a much larger asset, is a powerful tool. It allows you to amplify your returns in a way that is difficult to do safely with other investment types.

Strategic Selection Is Key

Of course, "safe" doesn't mean every property is a winner. Buying the wrong apartment in an oversupplied high-rise with no X factor or a house in a stagnant regional town can still result in poor performance.

To ensure safety and growth, you need to focus on fundamentals:

Proximity to jobs: Areas with diverse employment hubs are less risky.

Infrastructure: Look for suburbs benefiting from new transport or government spending.

Land component: Land appreciates; buildings depreciate. Prioritise assets with a high land-to-asset ratio.

Vacancy rates: Low vacancy rates (under 2%) suggest strong rental demand.

Looking Ahead

The Australian property market is evolving, but its core foundations remain rock solid. We have a growing population, a shortage of homes, and a culture that values homeownership.

While no investment is entirely risk-free, well-selected residential property remains the heavyweight champion for stability and long-term wealth in Australia. It’s not about getting rich quick; it’s about getting rich for sure.

Keen to understand how this applies to your situation? We’ll help you break it down and plan the next step.

Disclaimer:

The information in this article is general in nature and does not take into account your personal financial, legal, or tax circumstances. Property structures, tax regulations, and superannuation rules may change over time. You should seek advice from a qualified professional and refer to the latest ATO and government guidelines before making any investment or structuring decisions.

Comments